Over recent years, the fast advancement of cryptocurrencies and blockchain-based technologies has led to increased exploitation from criminals. From “pump and dump” scams to cybercrimes, the rapid rise of digital assets has raised questions about their exploitation by criminals to launder money and commit other act in untraceable and anonymous ways.

Lawmakers and regulators have been trying to figure out ways to combat threats such growing sector imposes. On February 17th, 2022, the Department of Justice announced its new National Cryptocurrency Enforcement Team (NCET) with newly appointed director, Eun Young Choi. Many argue that the newly formed NCET and FBI’s Virtual Asset Exploitation Unit launched on February 18th, 2022 signals more crackdowns on the crypto industry to come. As the possibility of regulations looms, what are some of the effects it may bring to the crypto and NFT markets?

Cryptocurrency

A cryptocurrency is an encrypted virtual currency that makes counterfeiting and double-spending almost impractical. In theory, unlike traditional currencies, virtual currencies are not controlled by any central authority; therefore, they are immune to government manipulation and intervention. Crypto refers to a range of encryption techniques and cryptographic approaches, including hashing algorithms, public-private key pairs, and elliptical curve encryption. Currently, Bitcoin is one of the most well-known and valuable cryptocurrencies on the market. It was invented and presented to the world in 2008 through a white paper by a mysterious entity known as Satoshi Nakamoto. Many new virtual currencies known as “altcoins” have sprung up upon Bitcoin’s success. Some are forks or splits of Bitcoin, and others are new currencies established from the ground up. Among them are Solana, Litecoin, Ethereum, Cardano, and EOS.

NFT

Non-fungible tokens (NFTs) are cryptographic currencies based on blockchains with unique identification numbers and information that differentiate them from one another. Unlike virtual currency, NFTs cannot be traded and purchased for counterparts. Artifacts such as digital art, sports cards, and rarities make up a large portion of the current market for NFTs. Many believe that NFTs revolutionize the cryptocurrency world by establishing one-of-a-kind and irreplaceable tokens. Similar to a digital passport, each token has its unique, non-transferable identity that makes it different from others. In many cases, they’re also made extendible, so you can combine two NFTs to get a third, distinct NFT. Non-fungible tokens may be used to electronically represent anything, including online-only assets like electronic artwork and real-world assets such as real estate investment. Avatars, electronic and non-digital treasures, website domains, and concert tickets are examples of goods that NFTs might represent.

Why are they so popular?

“Fortune favors the brave?” If you are like me, you may have been bombarded with the phrase for the past months by the Crpyto.com marketing campaign. As Matt Damon cruises through the history of mankind praising those who are bold enough to “embrace the moment” with such determination and conviction, it perfectly translates one of the biggest ideas behind crypto’s unbeaten popularity—that crypto enthusiasts are risk taker, innovators who are willing to be the early adopters of a historical revolution.

However, with company marketing teams adopting such mindsets, it inevitably creates situations where one is blindsided by the opportunity of being a part of something grander, putting them in highly vulnerable positions towards the risk and volatility of the crypto market. Nevertheless, the mass popularity of cryptocurrencies still appeals to some as a possibility to profit. Whether it is considered a long-term investment or a “get rich quick” opportunity, success stories do exist. Many have yield mass wealth thanks to the high-flying price of crypto and it is hard to eliminate the temptation of wanting to become the next.

On the practical side, the low transaction fees are one of the critical reasons cryptocurrencies and NFTs are so popular worldwide. You’ll typically be charged a lot of money when utilizing other types of online payment methods, making the meager prices connected with cryptocurrencies a far better deal in comparison. Second, these currencies are claimed to be unrelated to any international government. This means that virtual currencies may remain stable even when a country is in economic distress. Because some investors see cryptocurrencies as a realistic means of safeguarding their money, their value has climbed over time.

Further, many believe that using cryptocurrencies can make online purchases far more secure than other conventional payment methods. Moreover, as purchasing and trading cryptocurrencies from reputable sources become easier and accessible, the simplicity with which they may obtain also contributes to its popularity. Compared to the early age, cryptocurrency has also been getting easier to use as more online companies adopt it. More websites accept cryptocurrencies as a form of payment, and such trend is expected to continue by many.

In the past, individuals may have seen cryptocurrency as a shadowy and mysterious concept, but it has now become more of a commonplace. Ultimately, there are still many people who believe that cryptocurrencies are the way of the future for money. People interested in crypto trading and cryptocurrencies are also interested in significant technology advancements like blockchain. This enables them to be on the “cutting edge”, and many people appreciate the possibility to be ahead of the game. Blockchain technology is then expected to revolutionize the world in various ways, including making trades much more accessible.

“Web3 Is Going Great?”

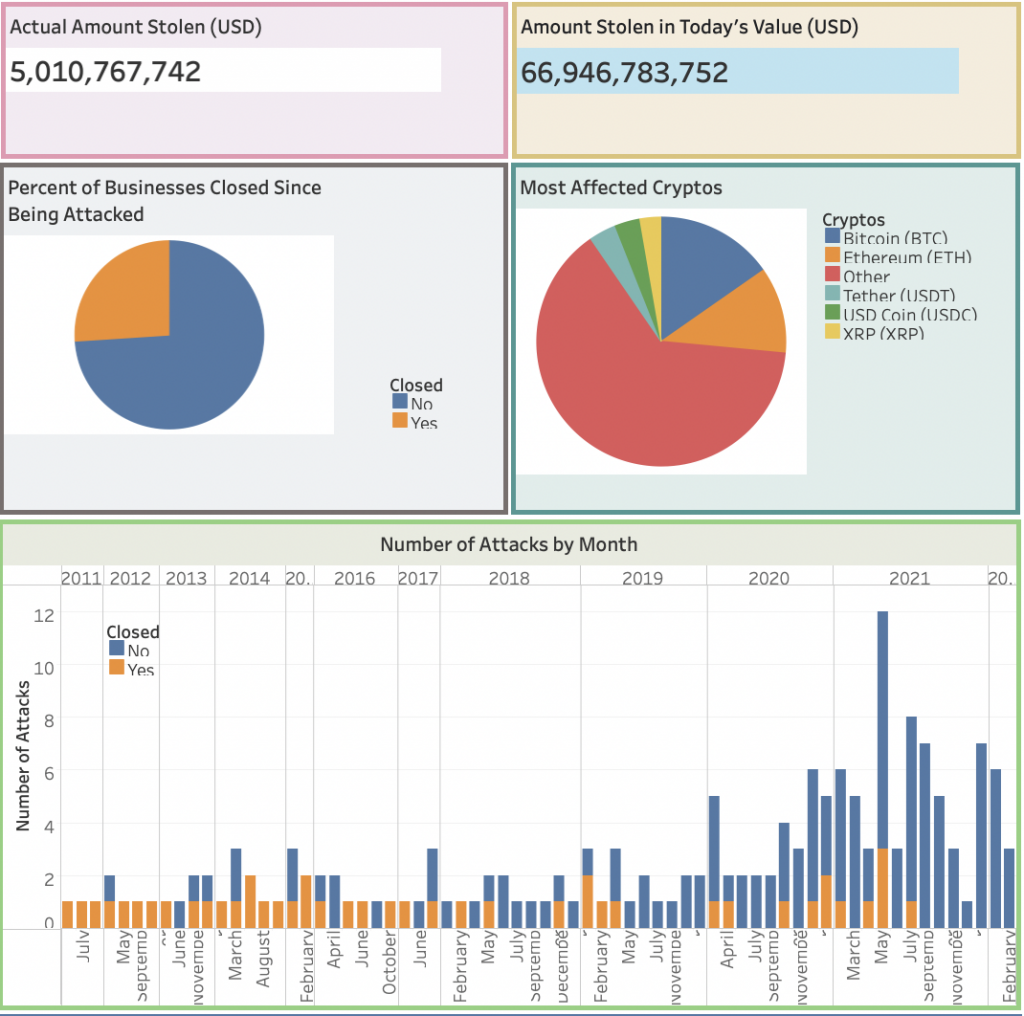

Despite the innovative format and technology, it is clear that severe hazards and risks are constantly associated with cryptocurrencies and NFTs to obstruct market acceptance and progress. “Web3 Is Going Great” is a website project created by software engineer Molly White, tracking some of the biggest scams, thefts, and controversies of the crypto space dating back to 2021, providing a visual representation of how Web3 may not be going as great as some think. Other platform “Worldwide Cryptocurrency Heists Tracker” offers an up to date documentation of the amount of cryptocurrencies that have been stolen in recent years, which until February 3rd, 2022, is $66,946,783,752 in today’s value (USD).

Money laundering has been a huge issue accompanied by the growth of the crypto market. There have been many cases where perpetrators utilize virtual currency to launder proceeds from various crimes, ranging from conspiracies to cybercrime, electronic theft, and cryptocurrency theft from internet interactions . To hide their sources, criminals use multiple techniques and services that deliver money to many locations or corporations. Subsequently, the assets are returned to a target location or an exchange liquidated from a legal source. This procedure makes tracing laundered money back to illegal activity very challenging. Crypto digital assets are also victims of “wash trading,” where users influence transactions by trading amongst themselves to boost the value of the NFT. The purpose of NFT wash trading is to make one’s NFT look like a better deal than it is by ‘selling’ it to a different wallet controlled by the actual owner.

Concerns over intellectual property are another critical factor on the list of NFT and cryptocurrency hazards and stumbling blocks. It’s crucial to assess a person’s complete ownership of an NFT. Yet numerous cases have been reported that NFTs were in fact photographed or that copies of NFTs have been distributed. Consequently, when one buys an NFT, the buyer is purchasing the right to use it rather than intellectual property rights. The metadata of the entire contract defines the terms and conditions for holding an NFT. The intellectual property risks and constraints associated with NFTs imply that purchasers only have the right to exhibit NFTs and are the only proprietors. Inside the Metaverse, the French luxury company Hermès is suing an individual for creating knock-off designer bags and selling for over six figures on secondary market, which is a clear case of copyright infringement . Early last month, the business launched a trademark infringement case against Mason Rothschild, a virtual designer, arguing that his MetaBirkins NFTs—virtual recreations of the classic Hermès handbag—were trademark infringement.

Regulations Pros

As relatively uncharted territories, cryptocurrency and NFTs regulations have received mixed reactions from crypto enthusiasts and investors. For those who believe in governmental regulations, some of the advantages of regulation include:

- Avoiding Scams

Scammers have infiltrated this sector because of its wild nature, producing a variety of fraudulent currencies. Cryptocurrency laws would verify that each cryptocurrency that enters the system satisfies specific standards. Individuals that invest in digital money will feel safer about their assets as a result.

- Getting Institutional Funds to Invest in the Markets

Investors would invest vast amounts of money into digital currencies if the market was regulated and precise operating mechanisms were in existence. The industry’s stability would improve, making it more efficient for investors. Huge pricing differences between markets, which exists now, would likely vanish.

- Providing moral legitimacy to the cryptocurrency market

For a long time, the virtual currency was perceived to be a tool used to purchase drugs, sex trafficking, and other illegal activities on the black market causing governments continuing to threaten cryptos with retaliation. China, along with few other countries, seem to be continuing an aggressive campaign against such risks, believing they represent a danger to the financial sector. With cryptocurrencies regulation, this unfavorable label could be no more. No nation would prohibit them if a worldwide regulatory framework directed the market. They would be seen as a much more viable investment option.

Regulation Cons

One of the biggest threats regulations imposes is a risk of cryptocurrency capital flight. Implementing government restrictions would be the same as putting governments into the industry, which crypto enthusiasts do not want to implement on their assets. As a result, conventional assets would see a flight to safety, as they are more secure. Such change makes it pointless to invest in a hazardous asset whose ideological goal is no longer evident. For example, since the Middle East nations began discussing regulation, the market has collapsed, with cryptocurrency plummeting by more than 50% (Matherson, 2021). Considering what would happen if rules were to be implemented globally, the value of cryptocurrencies would descend to the point where it would be a mere relic of the past.

“This regulation by enforcement that we’re seeing is not the way to go because it doesn’t create good policy. Regulators — in particular the SEC — think that the laws and regulations are crystal clear and that they’re very easy to interpret. But for those of us on the other side of the table that are working in the industry and its ecosystem, the laws aren’t clear, and it’s very difficult to figure out how to apply them.”

Kristin Smith, Executive Director at the Blockchain Association

Moreover, many have claimed that we simply have yet to understand enough to come up with a sustainable framework in regulating the crypto markets. Jumping the gun on regulation and policy making may seem viable in the short-run but would likely harm the NFT ecosystems and crypto-development on the whole.

Bibliography

Auer, Raphael and Claessens, Stijn, Regulating Cryptocurrencies: Assessing Market Reactions (September 1, 2018). BIS Quarterly Review September 2018, Available at SSRN: https://ssrn.com/abstract=3288097

Burns, Grayce. “Congress Shouldn’t Jump the Gun on NFT Regulations.” Reason Foundation, December 20, 2021. https://reason.org/commentary/congress-shouldnt-jump-the-gun-on-nft-regulations/.

Chohan, U. W. (2017). Cryptocurrencies: A brief thematic review. Available at SSRN 3024330. https://papers.ssrn.com/SOL3/PAPERS.CFM?ABSTRACT_ID=3024330

Clark, Mitchell. “NFTs, Explained.” The Verge. The Verge, March 3, 2021. https://www.theverge.com/22310188/nft-explainer-what-is-blockchain-crypto-art-faq.

Conti, Robyn. “What Is an NFT? Non-Fungible Tokens Explained.” Forbes. Forbes Magazine, February 16, 2022. https://www.forbes.com/advisor/investing/nft-non-fungible-token/.

Dafoe, Taylor. “Hermès Is Suing a Digital Artist for Selling Unauthorized Birkin Bag NFTS in the Metaverse for as Much as Six Figures.” Artnet News. Artnet News, January 26, 2022. https://news.artnet.com/art-world/hermes-metabirkins-2063954.

Dasgupta, N., Freifeld, C., Brownstein, J. S., Menone, C. M., Surratt, H. L., Poppish, L., … & Dart, R. C. (2013). Crowdsourcing black market prices for prescription opioids. Journal of Medical Internet Research, 15(8), e2810. https://www.jmir.org/2013/8/e178/.Are

“Justice Department Announces First Director of National Cryptocurrency Enforcement Team.” The United States Department of Justice, February 17, 2022. https://www.justice.gov/opa/pr/justice-department-announces-first-director-national-cryptocurrency-enforcement-team.

Kevin Helms A “FBI Launches ‘Virtual Asset Exploitation Unit’ with Specialized Team of Crypto Experts – Regulation Bitcoin News.” Bitcoin News, February 19, 2022. https://news.bitcoin.com/fbi-launches-virtual-asset-exploitation-unit-specialized-team-of-crypto-experts/.

Krion, Adrian. “NFT Regulation Looms Large, so Let’s Start with the Proper Framework.” Nasdaq. Accessed February 25, 2022. https://www.nasdaq.com/articles/nft-regulation-looms-large-so-lets-start-with-the-proper-framework.

Kurutz, Steven. “Teens Cash in on the NFT Art Boom.” The New York Times. The New York Times, August 14, 2021. https://www.nytimes.com/2021/08/14/style/teens-nft-art.html.

Likos, Paulina. “The History of Bitcoin, the First … – US News Money.” Accessed February 25, 2022. https://money.usnews.com/investing/articles/the-history-of-bitcoin.

Martinez, Jose. “Soulja Boy and Lil Yachty Are among Celebs Being Sued over Alleged ‘Pump and Dump’ Cryptocurrency Scheme.” Complex. Complex, February 22, 2022. https://www.complex.com/music/soulja-boy-lil-yachty-pump-and-dump-cryptocurrency-scheme.

Matherson, Nassor. 2021. The driving force of cryptocurrency and money laundering. Ph.D. diss., Utica College, https://www.proquest.com/dissertations-theses/driving-force-cryptocurrency-money-laundering/docview/2619239520/se-2?accountid=9902 (accessed February 25, 2022) .

Mejdrich, Kellie. “’Massive Wake-up Call’: Crypto Faces Growing Legal Crackdown.” POLITICO. POLITICO, August 17, 2021. https://www.politico.com/news/2021/08/17/cryptocurrency-legal-crackdown-505595.

Patel, Nilay. “Can the Law Keep up with Crypto?” The Verge. The Verge, February 22, 2022. https://www.theverge.com/22944579/crypto-bitcoin-internet-law-nft-tiktok-dances-tonya-evans-interview.

Person, and Charles B. Mckenna Hunt S. Ricker. “Cryptocurrency Finds Itself in the Sights of Robust Regulation.” Reuters. Thomson Reuters, January 24, 2022. https://www.reuters.com/legal/transactional/cryptocurrency-finds-itself-sights-robust-regulation-2022-01-24/ .

Small, Zachary. “Sotheby’s NFT Sale, Expected to Hit $30 Million, Suddenly Canceled.” The New York Times. The New York Times, February 24, 2022. https://www.nytimes.com/2022/02/24/arts/sothebys-nft-sale-canceled.html.

Stankiewicz , Matt. “What to Know about the DOJ’s National Cryptocurrency Enforcement Team.” JD Supra. Accessed March 4, 2022. https://www.jdsupra.com/legalnews/what-to-know-about-the-doj-s-national-1604480/.

“The Biggest Cryptocurrency Heists of All Time.” Comparitech, February 3, 2022. https://www.comparitech.com/crypto/biggest-cryptocurrency-heists/ .

White, Molly. “Web3 Is Going Just Great.” Illustration: A sad-looking Bored Ape Yacht Club NFT monkey looks at a world engulfed in flames. Accessed February 25, 2022. https://web3isgoinggreat.com/ .

Wilson, K. B., Karg, A., & Ghaderi, H. (2021). Prospecting non-fungible tokens in the digital economy: Stakeholders and ecosystem, risk and opportunity. Business Horizons. https://www.sciencedirect.com/science/article/pii/S0007681321002019