Who We Are

Who We Are

Hi! We are Studio Calibrate. We will be making a game focused on teaching various aspects of financial literacy on a mobile platform. Our team members are:

Kimberly Huang- Producer, Sound Designer

Toya Rosuello- Lead Programmer

MinSun Park- Programmer

Adela Kapuścińska- Lead Artist, Financial Expert

Oliver Tan- Artist, Financial Expert

Client’s Goals

Our client is a professor that works with a non-profit organization that deals with teaching high-schools financial literacy. He wants us to create a game that teaches financial literacy to children in the 8th to 10th grades. He foresees the game to be used either as a supplemental tool to a financial literacy course taught in school or as a final assessment kind of assignment. Therefore, he wants to emphasize scoring and replayability for the game, where students can go back and improve on previous scores after the game is finished. He also wanted the game to be a mobile game, so that it is accessible to more people.

In terms of how he wanted the game to be structured, our client wanted something that is very similar to The Game of LIFE, without the RNG that predetermines how the player progresses through the game. He wanted students to pick a career path and then manage their money while living out their life. Within that structure, players would have to learn about taxes, credit cards, and other forms of debt and financial management. The amount of money accessible to the player would change depending on the career they chose. Our client was very adamant about having different careers for the students to take and trying to make the financial concepts taught as detailed as possible. He also stressed the realism that he wanted in the game, focusing on real-life issues that the students may encounter.

The team decided that we did not want to recreate The Game of LIFE, so we asked the client what mechanics he definitely wanted in the game. The client came back with a few features that’d he’d like. First, as mentioned earlier, he wants a game that has replay value, especially one that allows the player to increase their score and learn from past iterations. He wants to focus on some key financial concepts and their consequences. Players should also be taught the ideas of immediate versus delayed gratification. Therefore, we want to put in a mechanic that gives the player a choice to get a smaller reward immediately or wait until another incident occurs to reap the benefits from their decisions. Going hand in hand with that idea, the client wants to make sure that the students are budgeting their money in game, as that is one of the things that he wants them to take away for the future. Lastly, he wants the students to explore various professions and understand that not every job produces the same amount of money or issues. Taking these ideas into account, the team created three initial game ideas to pitch to the client.

Initial Concepts

While thinking of initial designs of the game, the team wanted to think of a variety of games that could be both engaging and educational. Also considering the diverse range of interests in our target demographic, we wanted to

-

- Minigame-based Game– Players would have the opportunity to play a variety of minigames that would focus on different financial literacy concepts. After the player finished all the minigames, they would play a final game that combined all the concepts learned in the previous games. The inspiration for this idea came from games like Mario Party, where there isn’t necessarily a large overarching story, but quick-paced engaging small games. Some examples of games that could be included are card games and simple tycoon games. The advantages of this kind of game include being able to move through games quickly, high replayability, and being able to emphasize individual concepts. However, some disadvantages include the possibility that the player will ignore minigames they don’t like and that the games may be too shallow to teach financial literacy.

- Business Simulation/Resource Management– In this kind of game, the player would run a business or startup. At the beginning of the game, there will be a randomized set of economic scenarios, taking into account things like war and inflation, and then use that to set the stage for various unforeseen circumstances. Players would have to manage their business, but ultimately success would be determined by how they react to the randomized circumstances. Financial literacy would be taught through the mechanics of managing the business and the interaction between the player and the employees of the business. The inspiration for this kind of game came from games like Roller Coaster Tycoon and Oregon Trail. Advantages of this game involved a highly personalized game for the player and the opportunity to test knowledge by talking to employees. The disadvantages of this kind of game include a repetitive game loop and an unwillingness to replay.

- Branching Story Game– In this kind of game, the player would explore financial concepts through an immersive story. One example the team was thinking of was having the player play as the breadwinner of a family. With the money that the player makes, they have to budget how much of it is used, taking into account their children and parents. Some issues that could arise are like needing to save money for textbooks or being faced with unexpected medical costs for an elderly parent. The inspiration for this came came from games like Until Dawn. The advantages of this game are that it would create empathy in the player for the characters, thus making them more invested in making the right financial decision, and the high realism of the game so that the stakes of financial decisions can be applied outside the game. Disadvantages of the game include the hit or miss idea of a family situation that may not apply to the student and the discontinuity teaching financial concepts may bring to the narrative.

Finalized Concept

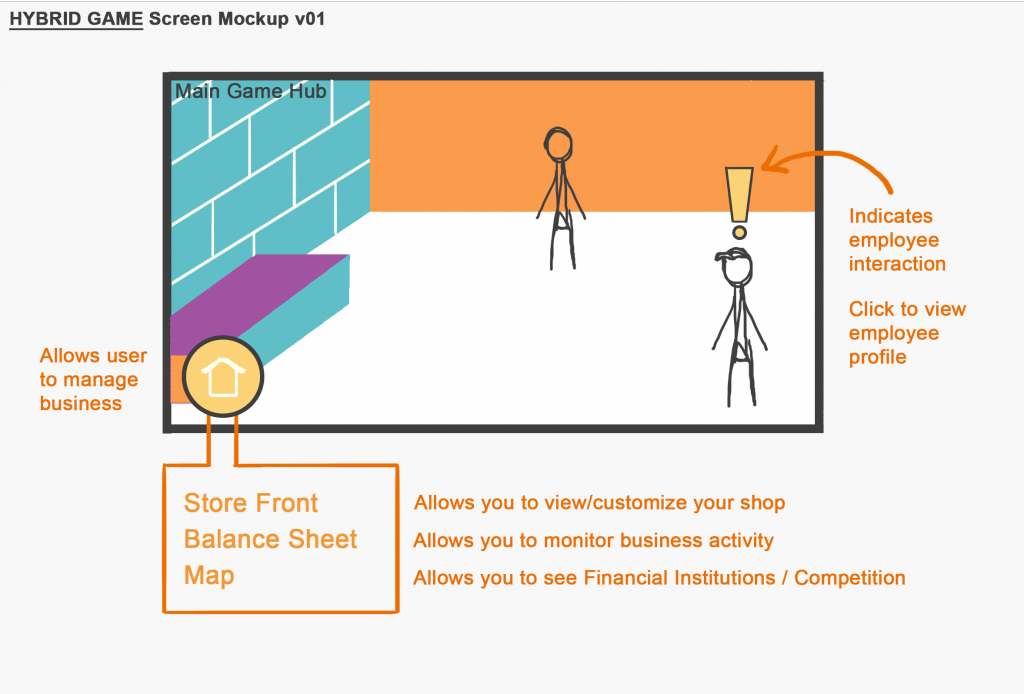

After getting advice from the instructor of the course, the team decided that a hybrid approach to the game would be the best way to incorporate everything the client wanted in a fun way. One of the struggles of creating this concept was reconciling what the client requested with what can actually be included in a game and still be fun. Since we are unsure how much exactly we should include, the team plans to conduct paper playtesting in the next few weeks to find the right balance of educational and enjoyable. The final concept the team has for this game keeps in mind the aforementioned issue and combines the three individual ideas from the above section. We decided to create a game where the main game is to run a business of the player’s choosing (of three). Within that, there would be employee interactions where the player will advise the employees on any financial problems they have, which is where we intend to place the financial concepts that we want to teach the students. Minigames will be incorporated to break up the narrative and make the game more engaging. We’ve also considered using the minigames to speed up the progress of tasks that may come with managing the business. By combining the three, we can create a game that is engaging for a wide range of people and have the player invest emotionally in the business.

A preliminary layout of what we’d like the game to look like.

Programming

Programmers decided on the first iteration of a class diagram for the game objects. Functions still need more planning as well as main game logic. Since minigames will be included, programmers decided to handle mini-game logic and main game logic in separate game managers. In the coming weeks, the plan is for programmers to finish the main business game mechanics first and then move on to implementing the minigames.

Concept Art / Writing

Artists made a few iterations of the main game hub. They’ve also started making concept art for the characters and outlining some of the character stories. We decided a 2.5D space would be the most engaging way for the game to be played. Artists have also started thinking about the character designs for the employees, working in conjunction with the writers.

Concept art for one of the store’s employees

Goals for Coming Weeks

Programmers should work on main game mechanics, allowing for the easy addition of minigames in later weeks. Ideally, a working prototype of the game including just the bank and buying and selling mechanics. Our production schedule is as follows:

| Week 4 (2/9-2/16): | Basic mechanics (bank, buying resources, equipment upgrades, etc.), written stories for the employees, main store screen, menu assets |

| Week 5 (2/16-2/23): | Basic mechanics (con’t), character assets, equipment assets |

| Week 6 (2/23-3/2): | Employee interaction, basic tutorials, storefront, sounds, storefront assets |